All golfers eventually want to buy a “golf cart” as they get older and have the potential to advance in their game. When they do this, they are initially faced with the question, “How Much Does Golf Cart Insurance Cost?” as a safety measure in case of unforeseen circumstances.

Because golf carts are an expensive purchase, it is important to protect that money. Getting golf cart insurance is the best protection you can give yourself. There are multiple factors that influence the cost of this insurance. It can be obtained for about $6 a month if it is added as an endorsement to your homeowners insurance.

Purchasing a separate policy for golf cart insurance usually costs about $7 a month. However, for modified or ATV golf carts, insurance expenses can be higher, averaging around $100 per month.

The objective of this article is to offer a thorough understanding of golf cart insurance, including the different kinds of coverage and related expenses. By the end of this guide, you will learn details to help you make informed decisions about safeguarding your valuable golf cart investment.

You will also require a license plate if you purchase the golf cart, so read our in-depth guide on “why do golf carts need license plates” for more information. Also read Do golf carts have seat belts?

How Much Does Golf Cart Insurance Cost?

There is no set price for golf cart insurance because there are a number of important variables that affect it. First of all, since insurance rates differ depending on where you live, your state matters. The type of golf cart you own, its intended use, and the particular coverage you select all affect the final cost.

You can add your golf cart as an endorsement to your homeowners insurance policy; this add-on usually costs about $6 a month. Choosing to purchase individual golf cart insurance could run you about $7 a month. Nevertheless, monthly premiums may be greater for customized golf carts with extra features, possibly topping $100.

Considering your particular needs and preferences, it is a good idea to get quotes from several insurance companies in order to discover the most appropriate and affordable coverage. You may like to read our detailed article on how much does a golf cart battery weigh?

Is Golf Cart Insurance Necessary?

Depending on the laws in your state, you may or may not need golf cart insurance, but it is essential for safeguarding your car. The kind of insurance depends on the kind of golf cart and how it is used. Below is a summary for various types of golf carts:

Standard Golf Cart:

- utilized on private property or golf courses.

- Usually included with property insurance.

- If you use a golf cart off the course, you might want to get separate insurance from an auto insurance provider because homeowners insurance might only pay for damage sustained in certain locations.

Modified Golf Cart:

- improved with extras like larger tires or a stronger motor.

- driven through neighborhoods and on golf courses.

- In order to guarantee adequate coverage, take into account auto insurance for low-speed vehicles (LSVs).

ATV Golf Cart:

- driven for a variety of purposes on streets and golf courses.

- Because of the various locations of use, appropriate coverage includes auto or umbrella insurance.

What Is Covered by Golf Cart Insurance?

Insurance for golf carts covers a range of potential losses connected to your vehicle. Depending on the insurance provider and the plan you select, the precise coverage may change. The following are typical coverages for golf cart insurance:

Property Damage Liability:

The costs of harm or destruction to private or public property brought on by your golf cart are covered by property damage liability. This covers situations in which your golf cart causes harm to a person’s mailbox, fence, car, or residence. The resulting damages are partially covered by this coverage.

Bodily Injury Liability:

Liability for bodily injury pays for costs associated with harm your golf cart causes to other people. This covers hospital expenses, defense costs in the event that the injured party files a lawsuit against you, and lost wages in the event that the injury prevents the injured party from working. It can also pay for funeral costs in extreme circumstances. It is critical to realize that bodily injury liability does not pay for medical costs associated with personal injuries.

Guest Passenger Liability:

Golf cart insurance may cover guest passenger liability, just like motorcycle insurance does. The cost of any passengers’ medical bills incurred while they are in your golf cart is covered by this coverage.

Collision:

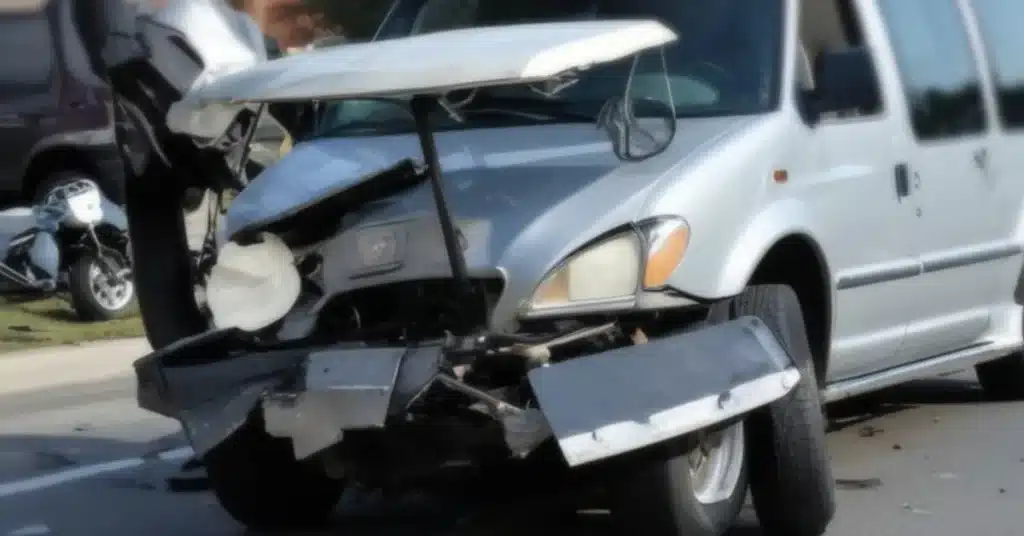

Accident-related damage to your golf cart is covered by collision coverage. This covers more serious issues that could result in your cart being totaled as well as more minor ones like dents or scratches. Collision insurance covers costs associated with rollovers or accidents, regardless of who is at fault.

Comprehensive Damage:

Hurricanes, tornadoes, and floods are examples of natural disasters for which comprehensive insurance offers coverage. It also offers defense against break-ins, theft, and damage from falling trees and branches. Your golf cart is guaranteed to be safe from a variety of potential hazards thanks to this extensive coverage. Also read how wide is a sandard golf cart?

How Can Golf Cart Insurance Help Me Save Money?

Of course! Golf cart insurance can be reduced in the following ways:

Explore Bundling Discounts:

If you combine your golf cart insurance with other policies, like homeowners or auto insurance, many insurance companies will give you a discount. Purchasing multiple policies from one insurance company frequently leads to lower overall costs.

Check for homeowner Discounts:

For those who already have a homeowners insurance policy with them, some insurers offer a discount on golf cart insurance. Ask your insurance company if there are any possible savings for having several policies with them.

Drive Safely:

Keeping up a safe driving record may enable you to receive a reduction in insurance costs. Steer clear of collisions and moving infractions; a history of careful driving will often result in cheaper insurance costs.

Additionally, it is wise to:

- Install Safety Features: You may qualify for additional savings if your golf cart has safety features like seat belts, headlights, and turn signals.

- Finish a Safety Course: Owners of golf carts who have finished a safety course may be eligible for discounts from some insurance companies. Find out if your insurance has any recommendations or requirements regarding safety courses by contacting them.

- Select a Higher Deductible: You can cut your insurance costs by choosing a higher deductible. That being said, you must make sure that, should the need arise, you can afford the deductible.

- Keep Your Coverage Limit Low for Older Carts: You should think about lowering your coverage limits if your golf cart is older and has a lower value. This might lower your insurance premiums, but you need to balance the savings with sufficient coverage.

Final Thoughts- How Much Does Golf Cart Insurance Cost?

It is imperative that you obtain golf cart insurance for both financial and vehicle security. The type of cart and coverage determine the price. Select a reliable insurance provider with a solid track record. To guarantee complete protection, put more emphasis on obtaining the appropriate coverage than the cheapest price.

Frequently Asked Questions- How Much Does Golf Cart Insurance Cost?

Is golf cart insurance required?

Depending on the state where you reside, golf cart insurance may be required. While some states require insurance, others do not. It is advisable to obtain insurance to safeguard your investments and liabilities, even in states where it is not legally required.

What factors influence the cost of golf cart insurance?

The type of golf cart, its intended use, your location, the level of coverage selected, and whether you choose a separate golf cart insurance policy or an endorsement for your homeowners insurance all have an impact on the cost of golf cart insurance.

Can I add my golf cart to homeowner’s insurance?

Absolutely, you can frequently add an endorsement to your homeowners insurance policy for a golf cart. This is a popular and affordable option, typically costing about $6 per month. To guarantee proper protection, it is important to read the terms as the coverage may be restricted to particular areas.